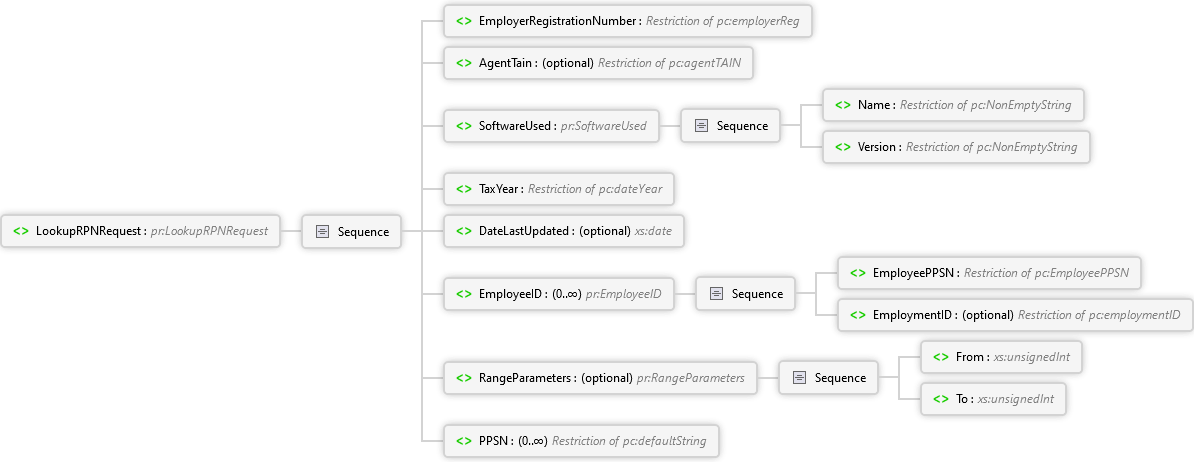

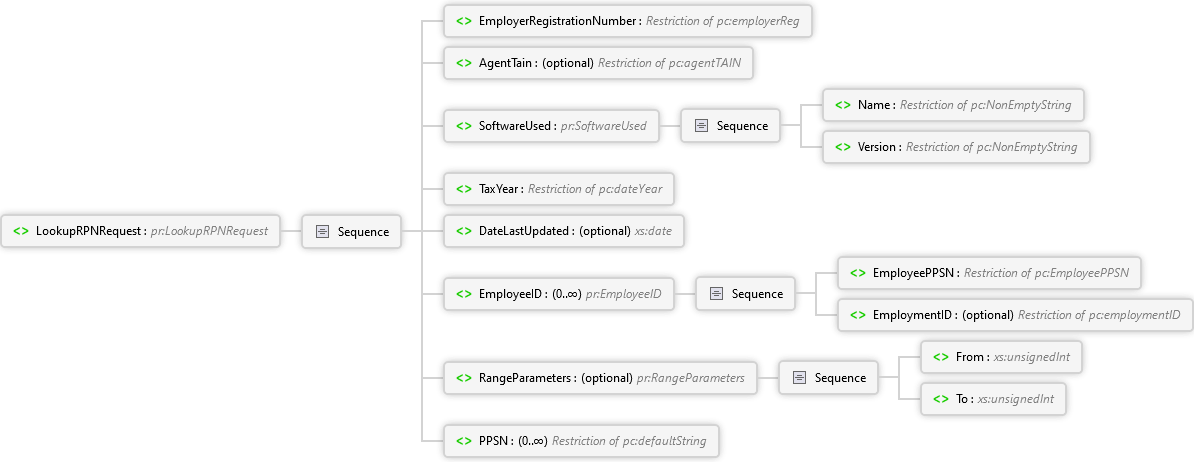

The request body is of type LookupRPNRequest.

Overview

|

LookupRPNRequest

Employer's Lookup RPN Request.

|

| Method | LookupRPNOperation |

The request body is of type LookupRPNRequest.

|

LookupRPNRequest

Employer's Lookup RPN Request.

|

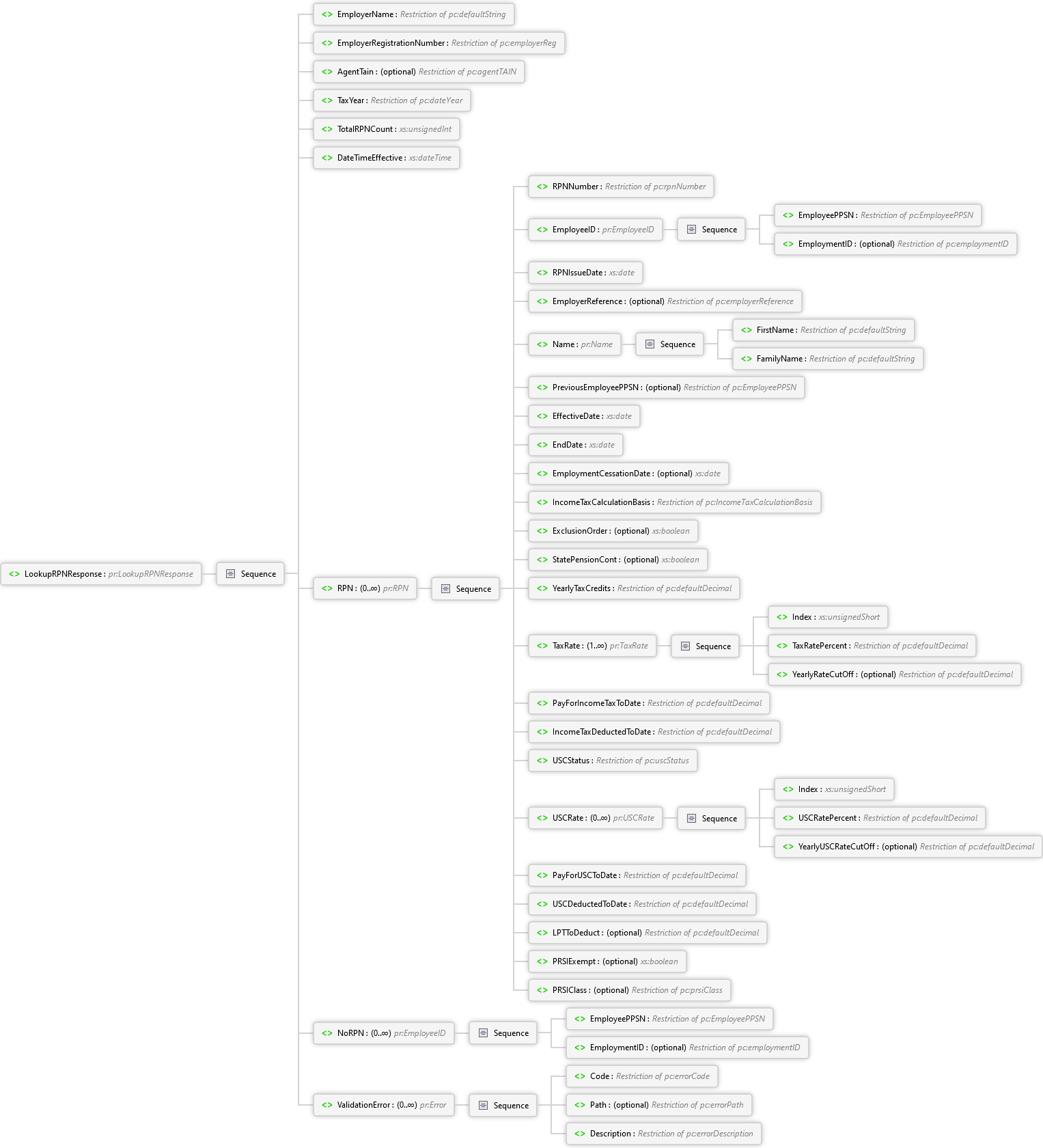

The response body is of type LookupRPNResponse.

|

LookupRPNResponse

Employer's Lookup RPN Response. Will either return RPN detail or details of validation errors.

|

<?xml version="1.0" encoding="UTF-8"?> <!--Document History: ======== Version 0.9 ==================================== i. Document Created 30/06/2017 ======== Version 0.10 ==================================== ii. Document updated on 07/09/2017: Revenue Payroll Instruction changed to Revenue Payroll Notification and RPI changed to RPN ======== Version 1.0 Milestone 1 ==================================== iii. Document updated on 17/11/2017: Renamed the element: "employeePPSN" to "EmployeePPSN" ======== Version 1.0 Milestone 2 ==================================== iv. Document updated on 09/02/2018: Dates re-formatted ======== Version 1.0 Release Candidate 2 =========== v. Document updated on 24/05/2018 Updated ENUM Values to reflect schematic changes --> <rat:LookupRPNRequest xmlns:rat="http://www.ros.ie/schemas/paye-employers/v1/rpn/" xmlns="http://www.ros.ie/schemas/paye-employers/v1/rpn/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ros.ie/schemas/paye-employers/v1/rpn/rpn-schema-pit3.xsd"> <rat:EmployerRegistrationNumber>3980609P</rat:EmployerRegistrationNumber> <rat:SoftwareUsed> <rat:Name>The Software</rat:Name> <rat:Version>Version 10.0</rat:Version> </rat:SoftwareUsed> <rat:TaxYear>2019</rat:TaxYear> <rat:DateLastUpdated>2019-01-10</rat:DateLastUpdated> <rat:EmployeeID> <rat:EmployeePPSN>00000008P</rat:EmployeePPSN> <rat:EmploymentID>1</rat:EmploymentID> </rat:EmployeeID> </rat:LookupRPNRequest>

<?xml version="1.0" encoding="UTF-8"?> <!--Document History: ======== Version 0.9 ==================================== i. Document Created 30/06/2017 ======== Version 0.10 ==================================== ii. Document updated on 07/09/2017: Revenue Payroll Instruction changed to Revenue Payroll Notification and RPI changed to RPN ======== Version 1.0 Milestone 1 ==================================== iii. Document updated on 17/11/2017: Renamed the element: "employeePPSN" to "EmployeePPSN" Renamed the element: "calculationBasis" to "IncomeTaxCalculationBasis" Renamed the element: "DateLastUpdated" to "RPNIssueDate" Renamed the element: "YearlyUSCCutOff" to "YearlyUSCRateCutOff" Renamed the element: "PayToDate" to "PayForIncomeTaxToDate" Renamed the element: "TaxToDate" to "IncomeTaxDeductedToDate" Renamed the element: "USCPaidToDate" to "USCDeductedToDate" ======== Version 1.0 Milestone 2 ==================================== iv. Document updated on 09/02/2018: Date/Time re-formatted ======== Version 1.0 Release Candidate 2 =========== v. Document updated on 24/05/2018 Updated ENUM Values to reflect schematic changes --> <rat:LookupRPNResponse xmlns:rat="http://www.ros.ie/schemas/paye-employers/v1/rpn/" xmlns="http://www.ros.ie/schemas/paye-employers/v1/rpn/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ros.ie/schemas/paye-employers/v1/rpn/rpn-schema-pit3.xsd"> <rat:EmployerName>Employer1</rat:EmployerName> <rat:EmployerRegistrationNumber>3980609P</rat:EmployerRegistrationNumber> <rat:TaxYear>2019</rat:TaxYear> <rat:TotalRPNCount>1</rat:TotalRPNCount> <rat:DateTimeEffective>2019-01-29T11:58:02.000+00:00</rat:DateTimeEffective> <rat:RPN> <rat:RPNNumber>5</rat:RPNNumber> <rat:EmployeeID> <rat:EmployeePPSN>00000008P</rat:EmployeePPSN> <rat:EmploymentID>1</rat:EmploymentID> </rat:EmployeeID> <rat:RPNIssueDate>2019-01-10</rat:RPNIssueDate> <rat:Name> <rat:FirstName>Ann</rat:FirstName> <rat:FamilyName>Doe</rat:FamilyName> </rat:Name> <rat:EffectiveDate>2019-01-01</rat:EffectiveDate> <rat:EndDate>2019-12-31</rat:EndDate> <rat:IncomeTaxCalculationBasis>CUMULATIVE</rat:IncomeTaxCalculationBasis> <rat:YearlyTaxCredits>3300.00</rat:YearlyTaxCredits> <rat:TaxRate> <rat:Index>1</rat:Index> <rat:TaxRatePercent>20</rat:TaxRatePercent> <rat:YearlyRateCutOff>33800.00</rat:YearlyRateCutOff> </rat:TaxRate> <rat:TaxRate> <rat:Index>2</rat:Index> <rat:TaxRatePercent>40</rat:TaxRatePercent> </rat:TaxRate> <rat:PayForIncomeTaxToDate>1230.00</rat:PayForIncomeTaxToDate> <rat:IncomeTaxDeductedToDate>0.00</rat:IncomeTaxDeductedToDate> <rat:USCStatus>ORDINARY</rat:USCStatus> <rat:USCRate> <rat:Index>1</rat:Index> <rat:USCRatePercent>.5</rat:USCRatePercent> <rat:YearlyUSCRateCutOff>12012.00</rat:YearlyUSCRateCutOff> </rat:USCRate> <rat:USCRate> <rat:Index>2</rat:Index> <rat:USCRatePercent>2.5</rat:USCRatePercent> <rat:YearlyUSCRateCutOff>18772.00</rat:YearlyUSCRateCutOff> </rat:USCRate> <rat:USCRate> <rat:Index>3</rat:Index> <rat:USCRatePercent>5</rat:USCRatePercent> <rat:YearlyUSCRateCutOff>70044.00</rat:YearlyUSCRateCutOff> </rat:USCRate> <rat:USCRate> <rat:Index>4</rat:Index> <rat:USCRatePercent>8</rat:USCRatePercent> </rat:USCRate> <rat:PayForUSCToDate>1230.00</rat:PayForUSCToDate> <rat:USCDeductedToDate>12.28</rat:USCDeductedToDate> <rat:LPTToDeduct>191.00</rat:LPTToDeduct> </rat:RPN> </rat:LookupRPNResponse>