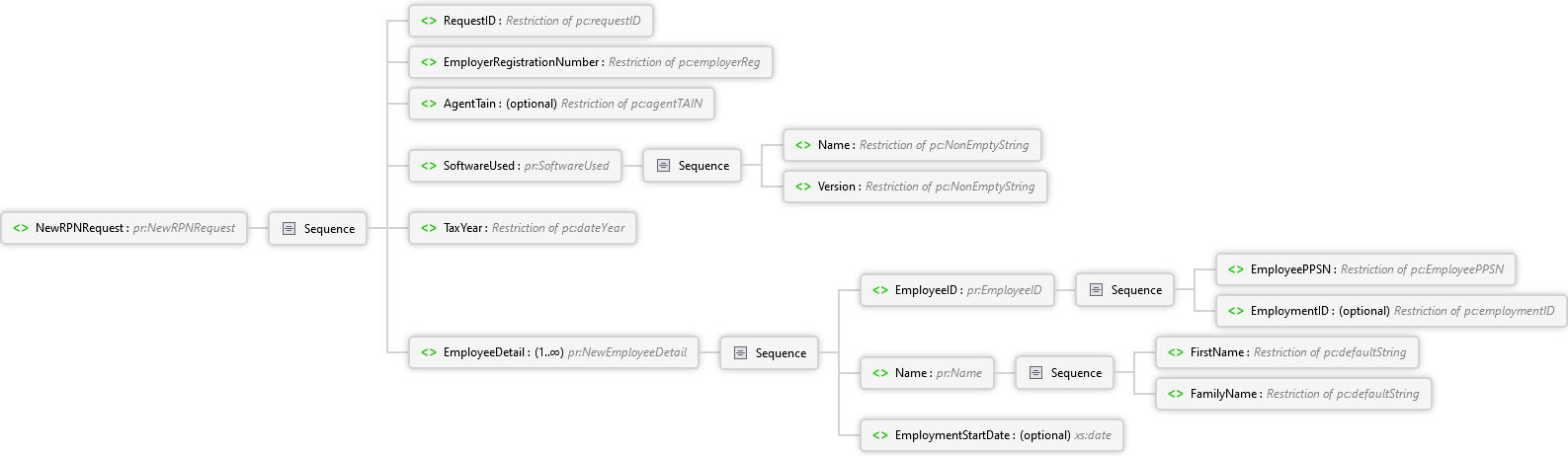

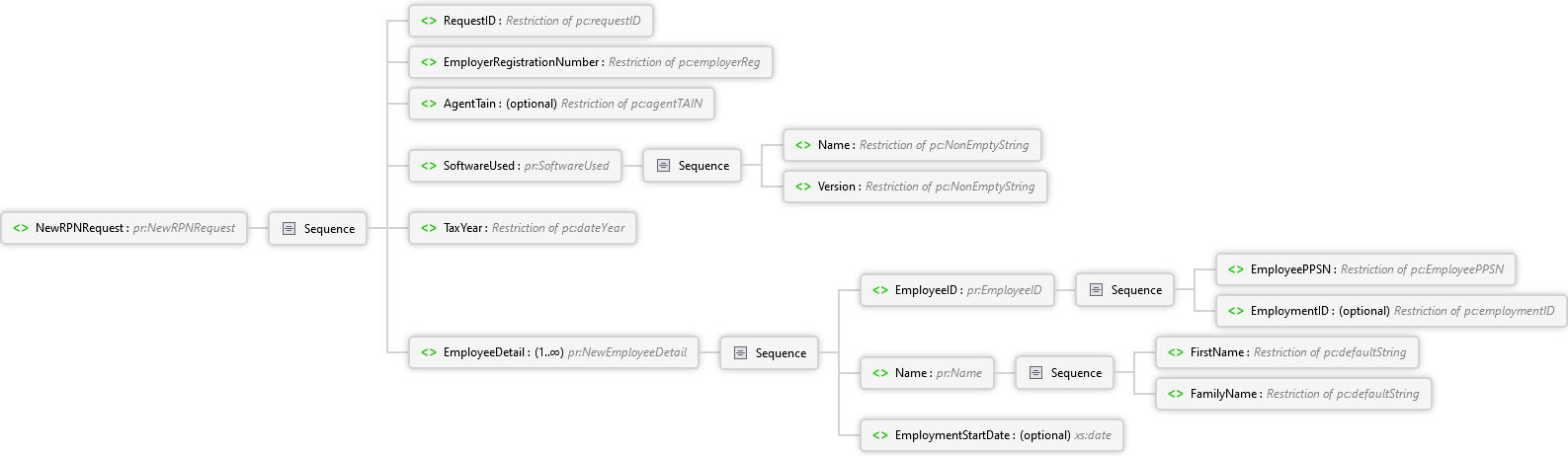

Request (NewRPNRequest)

The request body is of type NewRPNRequest.

Overview

|

|

Sequence

|

RequestID requestID Simple Type

Data Item Ref: N/A. Unique identifier for the New RPN Request. Will be used in conjunctions with the EmployerRegistrationNumber to check for duplicate requests.

|

|

AgentTain optional agentTAIN Simple Type

Data Item Ref: N/A. Tax Advisor Identification Number. Required if payroll submission filed by agent on behalf of employer.

|

|

|

Sequence

| |

|

|

Sequence

|

|

Sequence

|

EmploymentID optional employmentID Simple Type

Data Item Ref: 110. Employee's Employment ID. Unique identifier for each distinct employment for an employee. If the RPN is being triggered as a result of the employee setting up the employment via Jobs and Pension or contacting Revenue, this field will not be populated.

| | |

|

|

Sequence

| |

|

EmploymentStartDate optional xs:date

Data Item Ref: N/A. The date which the employee commences (YYYY-MM-DD).

| | | | |

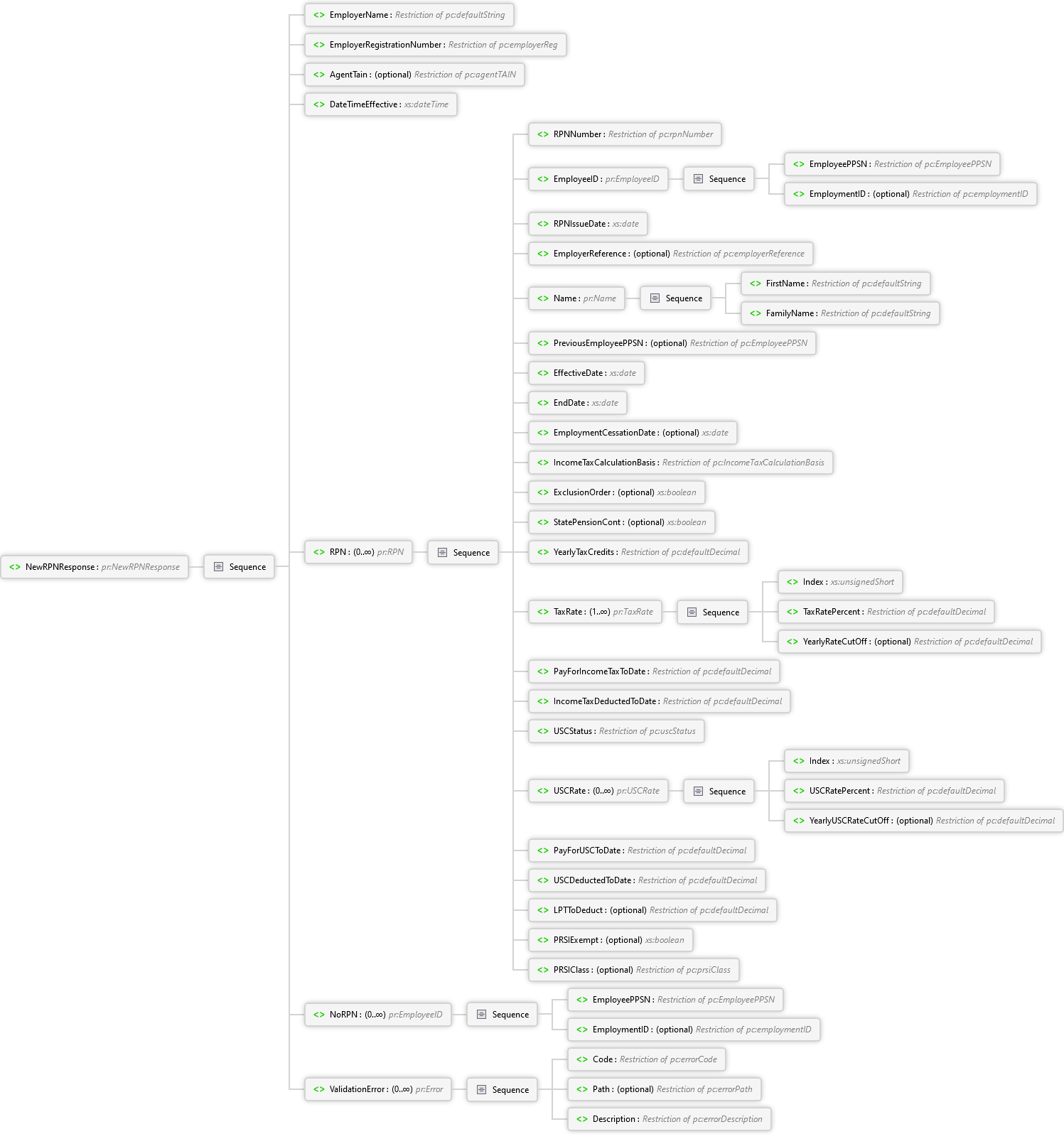

200 Response (NewRPNResponse)

The response body is of type NewRPNResponse.

Overview

|

NewRPNResponse

Employer's New RPN Response. Will either return RPN detail or details of validation errors.

|

Sequence

|

AgentTain optional agentTAIN Simple Type

Data Item Ref: N/A. Tax Advisor Identification Number. Required if RPN queried by agent on behalf of employer.

|

|

DateTimeEffective xs:dateTime

Data Item Ref: 105. The date and time at which the RPN's returned are correct/were issued (YYYY-MM-DDThh:mm:ss.sss±hh:mm).

|

|

|

Sequence

|

|

Sequence

|

EmploymentID optional employmentID Simple Type

Data Item Ref: 110. Employee's Employment ID. Unique identifier for each distinct employment for an employee. If the RPN is being triggered as a result of the employee setting up the employment via Jobs and Pension or contacting Revenue, this field will not be populated.

| | |

|

RPNIssueDate xs:date

Data Item Ref: 105. The date the RPN was issued (YYYY-MM-DD).

|

|

|

Sequence

| |

|

EffectiveDate xs:date

Data Item Ref: 114. January 1st if cumulative basis applies. Date the RPN issued if Week 1 basis applies. The date can be in the future (YYYY-MM-DD).

|

|

EndDate xs:date

Data Item Ref: 115. Last date on which the RPN specified will apply. After this date a new RPN should be requested.

|

|

EmploymentCessationDate optional xs:date

Data Item Ref: 136. Conditionally returned if present for the employment. Employment Cessation Date

|

|

ExclusionOrder optional xs:boolean

Data Item Ref: 113. Indicates if there is an exclusion order on file for the employee. Set to “true” if an exclusion order is on file for the employee.

|

|

StatePensionCont optional xs:boolean

Data Item Ref: 137. True for an employee drawing down their state pension contributory. Default from 2025 onwards is false.

|

|

YearlyTaxCredits defaultDecimal Simple Type

Data Item Ref: 118. Net Tax Credits. Amount of tax credits available to the employee for the year the RPN relates to. Amount of tax credits available for use in the PAYE calculation.

|

|

|

Sequence

|

Index xs:unsignedShort

Data Item Ref: N/A. Index of the tax rate. For example, Index of 1 would refer to tax rate 1.

|

| |

|

PayForIncomeTaxToDate defaultDecimal Simple Type

Data Item Ref: 116. Total Pay for Income Tax to Date. This will include total income liable to Income Tax to date – including previous employment income. In the case of recommencements, this includes previous pay from that employer in the same tax year.

|

|

IncomeTaxDeductedToDate defaultDecimal Simple Type

Data Item Ref: 117. Total Income Tax Deducted to Date. Total amount of employee’s Income Tax deducted to date. In the case of recommencements, this includes previous tax from that employer in the same tax year.

|

|

|

Sequence

|

Index xs:unsignedShort

Data Item Ref: N/A. Index of the rate. For example, Index of 1 would refer to USC Tax Rate 1.

|

| |

|

PayForUSCToDate defaultDecimal Simple Type

Data Item Ref: 133. Total Previous Pay subject to USC to Date. This will include total income liable to USC to date – including previous employment income and any additional declared income liable to USC e.g. Rental Income.

|

|

PRSIExempt optional xs:boolean

Data Item Ref: 122. True if employee is exempt from paying PRSI in Ireland. This field is only included if the employee is exempt from paying PRSI.

|

|

PRSIClass optional prsiClass Simple Type

Data Item Ref: 123. PRSI Class and Subclass that the employee should be updated to. This will appear only where DSP updates the class or where DSP knows the individual is on the wrong class. i.e. where a review has been carried out by DSP.

| | |

|

NoRPN 0..∞ EmployeeID Complex Type

Data Item Ref: N/A. Employees where no RPN details could be returned. These employees should be calculated under an Emergency basis.

|

Sequence

|

EmploymentID optional employmentID Simple Type

Data Item Ref: 110. Employee's Employment ID. Unique identifier for each distinct employment for an employee. If the RPN is being triggered as a result of the employee setting up the employment via Jobs and Pension or contacting Revenue, this field will not be populated.

| | |

|

|

Sequence

| | | |

See Also