The request body is of type CheckPayrollRunRequest.

Overview

|

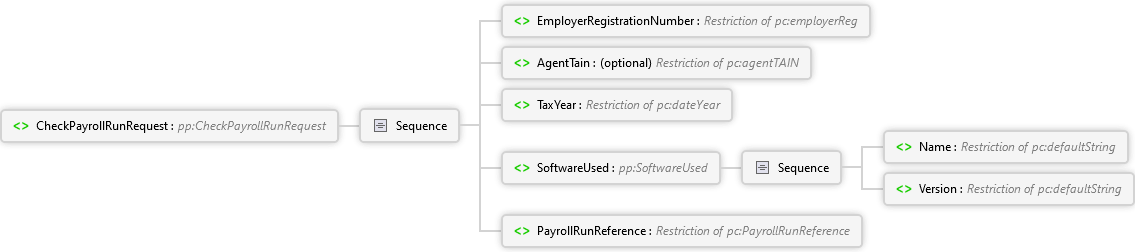

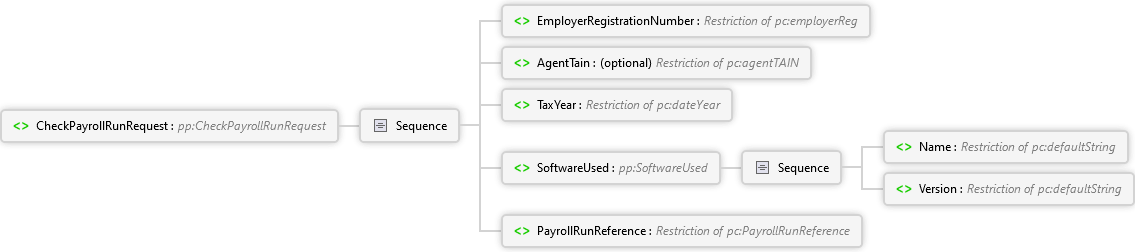

CheckPayrollRunRequest

Request to check the current status of an Employer's PAYE Payroll Run, based on the RunReference.

|

| Method | CheckPayrollRunOperation |

The request body is of type CheckPayrollRunRequest.

|

CheckPayrollRunRequest

Request to check the current status of an Employer's PAYE Payroll Run, based on the RunReference.

|

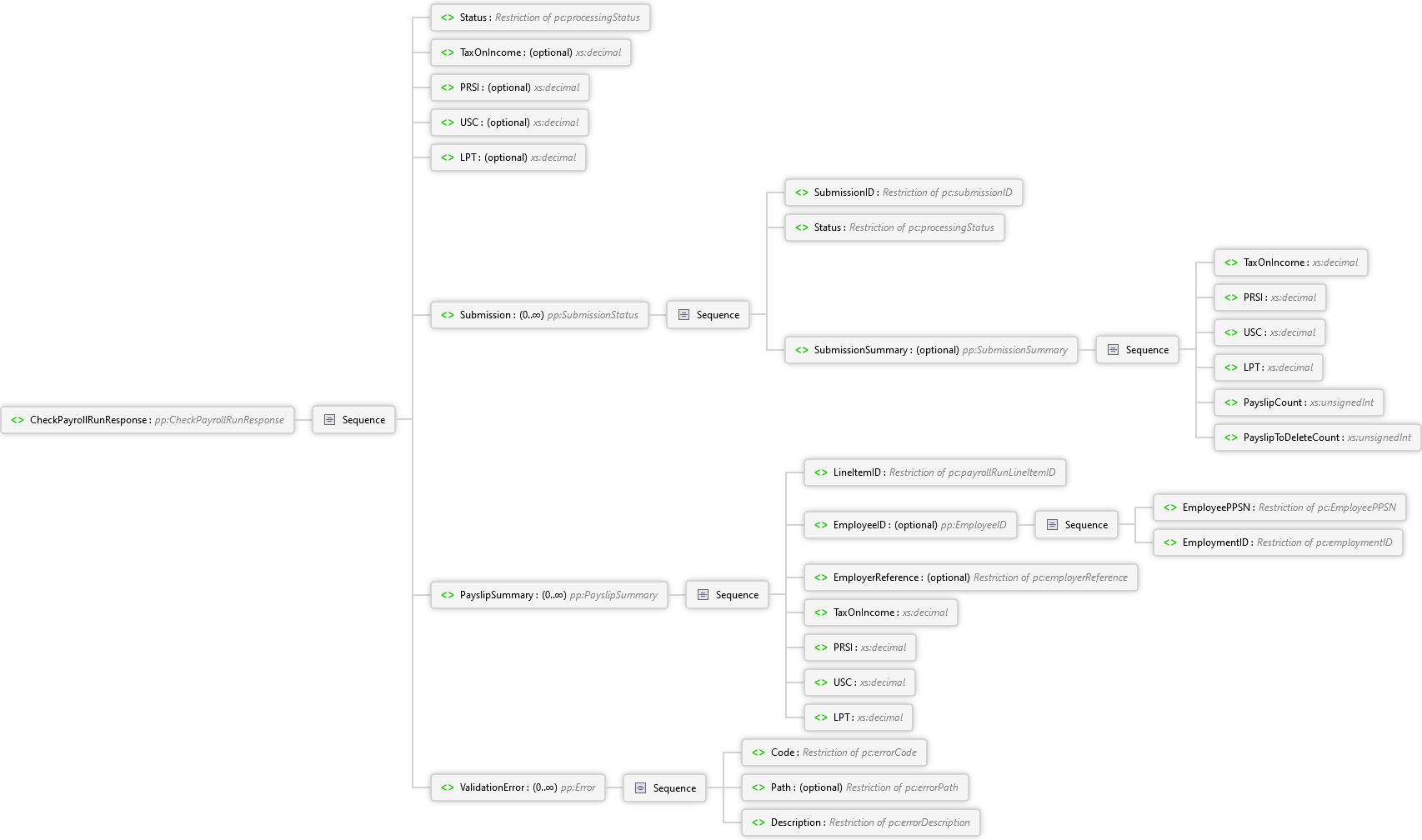

The response body is of type CheckPayrollRunResponse.

|

CheckPayrollRunResponse

Return the current status of an Employer's PAYE Payroll Run. Includes list of submissions that make up the payroll run and includes summary details of processed submissions.

|

<?xml version="1.0" encoding="UTF-8"?> <!--Document History: ======== Version 0.9 ==================================== i. Document Created 30/06/2017 ======== Version 0.10 ==================================== ii. Document updated on 07/09/2017: The element "TaxYear" was added to the "CheckPayrollRunRequest" ======== Version 1.0 Milestone 1 ==================================== iii. Document updated on 17/11/2017: Renamed the element: "RunReference" to "PayrollRunReference" ======== Version 1.0 Release Candidate 2 =========== v. Document updated on 24/05/2018 Updated ENUM Values to reflect schematic changes --> <pay:CheckPayrollRunRequest xmlns:pay="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ros.ie/schemas/paye-employers/v1/payroll/payroll-schema.xsd"> <pay:EmployerRegistrationNumber>3980609P</pay:EmployerRegistrationNumber> <pay:TaxYear>2019</pay:TaxYear> <pay:SoftwareUsed> <pay:Name>The Software</pay:Name> <pay:Version>Version 10.0</pay:Version> </pay:SoftwareUsed> <pay:PayrollRunReference>00001</pay:PayrollRunReference> </pay:CheckPayrollRunRequest>

<?xml version="1.0" encoding="UTF-8"?> <!--Document History: ======== Version 0.9 ==================================== i. Document Created 30/06/2017 ======== Version 0.10 ==================================== ii. Document updated on 07/09/2017: The complex type "PayslipSummary" was added to the "CheckPayrollRunResponse" ====== Version 1.0 Milestone 1 ==================================== iii. Document updated on 17/11/2017: Renamed the element: "PPSN" to "EmployeePPSN" ======== Version 1.0 Release Candidate 2 =========== v. Document updated on 24/05/2018 Updated ENUM Values to reflect schematic changes --> <pay:CheckPayrollRunResponse xmlns:pay="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ros.ie/schemas/paye-employers/v1/payroll/payroll-schema.xsd"> <pay:Status>PROCESSED</pay:Status> <pay:TaxOnIncome>1334.48</pay:TaxOnIncome> <pay:PRSI>1535.55</pay:PRSI> <pay:USC>333.94</pay:USC> <pay:LPT>48.75</pay:LPT> <pay:Submission> <pay:SubmissionID>05</pay:SubmissionID> <pay:Status>COMPLETED</pay:Status> <pay:SubmissionSummary> <pay:TaxOnIncome>1334.48</pay:TaxOnIncome> <pay:PRSI>1535.55</pay:PRSI> <pay:USC>333.94</pay:USC> <pay:LPT>48.75</pay:LPT> <pay:PayslipCount>6</pay:PayslipCount> <pay:PayslipToDeleteCount>0</pay:PayslipToDeleteCount> </pay:SubmissionSummary> </pay:Submission> <pay:PayslipSummary> <pay:LineItemID>E1-v1</pay:LineItemID> <pay:EmployeeID> <pay:EmployeePPSN>1175228T</pay:EmployeePPSN> <pay:EmploymentID>1</pay:EmploymentID> </pay:EmployeeID> <pay:TaxOnIncome>226.17</pay:TaxOnIncome> <pay:PRSI>381.04</pay:PRSI> <pay:USC>70.04</pay:USC> <pay:LPT>0</pay:LPT> </pay:PayslipSummary> <pay:PayslipSummary> <pay:LineItemID>E2-v1</pay:LineItemID> <pay:EmployeeID> <pay:EmployeePPSN>1175228T</pay:EmployeePPSN> <pay:EmploymentID>2</pay:EmploymentID> </pay:EmployeeID> <pay:TaxOnIncome>417.84</pay:TaxOnIncome> <pay:PRSI>177</pay:PRSI> <pay:USC>60</pay:USC> <pay:LPT>0</pay:LPT> </pay:PayslipSummary> <pay:PayslipSummary> <pay:LineItemID>E3-v2</pay:LineItemID> <pay:EmployeeID> <pay:EmployeePPSN>2548936K</pay:EmployeePPSN> <pay:EmploymentID>1</pay:EmploymentID> </pay:EmployeeID> <pay:TaxOnIncome>0</pay:TaxOnIncome> <pay:PRSI>19.89</pay:PRSI> <pay:USC>.93</pay:USC> <pay:LPT>0</pay:LPT> </pay:PayslipSummary> <pay:PayslipSummary> <pay:LineItemID>E4-v3</pay:LineItemID> <pay:EmployeeID> <pay:EmployeePPSN>7425001H</pay:EmployeePPSN> <pay:EmploymentID>1</pay:EmploymentID> </pay:EmployeeID> <pay:TaxOnIncome>117.11</pay:TaxOnIncome> <pay:PRSI>381.04</pay:PRSI> <pay:USC>37.29</pay:USC> <pay:LPT>0</pay:LPT> </pay:PayslipSummary> <pay:PayslipSummary> <pay:LineItemID>E5-v1</pay:LineItemID> <pay:EmployeeID> <pay:EmployeePPSN>0852473A</pay:EmployeePPSN> <pay:EmploymentID>1</pay:EmploymentID> </pay:EmployeeID> <pay:TaxOnIncome>476.42</pay:TaxOnIncome> <pay:PRSI>605.98</pay:PRSI> <pay:USC>146.29</pay:USC> <pay:LPT>48.75</pay:LPT> </pay:PayslipSummary> <pay:PayslipSummary> <pay:LineItemID>E6-v3</pay:LineItemID> <pay:EmployerReference>0001</pay:EmployerReference> <pay:TaxOnIncome>96.94</pay:TaxOnIncome> <pay:PRSI>20.60</pay:PRSI> <pay:USC>19.39</pay:USC> <pay:LPT>0</pay:LPT> </pay:PayslipSummary> </pay:CheckPayrollRunResponse>