Data Item Ref: 15. Employment ID. Unique identifier for each distinct employment for an employee. To be set by the employer.

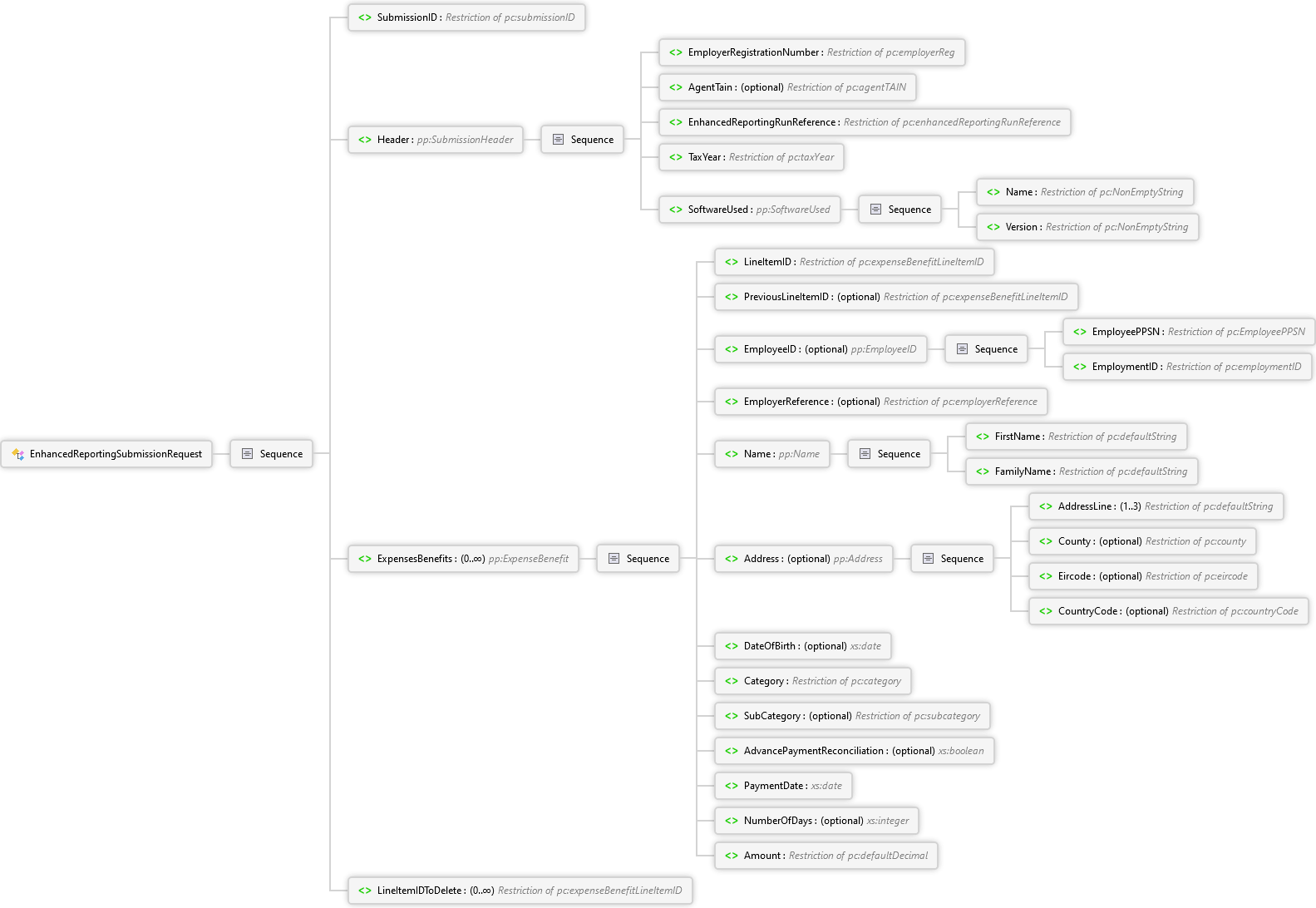

Enhanced Reporting Schema

EmploymentID Element

| Namespace | http://www.ros.ie/schemas/paye-employers/err/v1/enhanced_reporting/ |

|

EmploymentID employmentID Simple Type

Data Item Ref: 15. Employment ID. Unique identifier for each distinct employment for an employee. To be set by the employer. |

|