Required header level elements for a payroll submission.

Payroll Schema

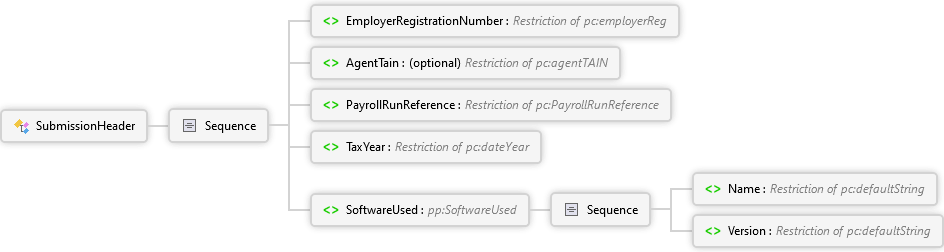

SubmissionHeader Complex Type

| Namespace | http://www.ros.ie/schemas/paye-employers/v1/payroll/ |

|

SubmissionHeader

Required header level elements for a payroll submission.

|

|