Response that lets the employer/agent view a return for a specific period.

Returns Reconciliation Schema

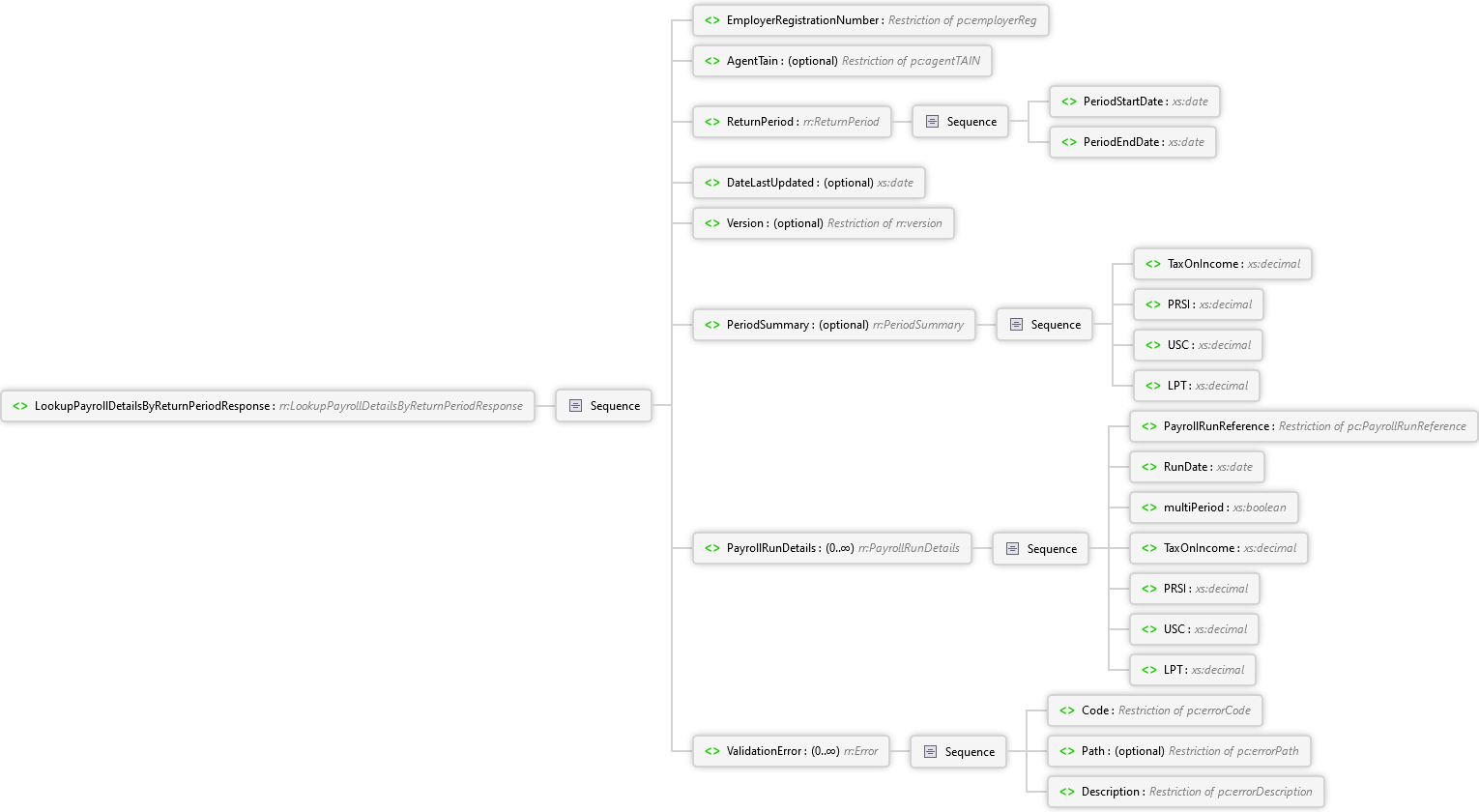

LookupPayrollDetailsByReturnPeriodResponse Element

| Namespace | http://www.ros.ie/schemas/paye-employers/v1/returns_reconciliation/ |

|

LookupPayrollDetailsByReturnPeriodResponse LookupPayrollDetailsByReturnPeriodResponse Complex Type

Response that lets the employer/agent view a return for a specific period.

|

|