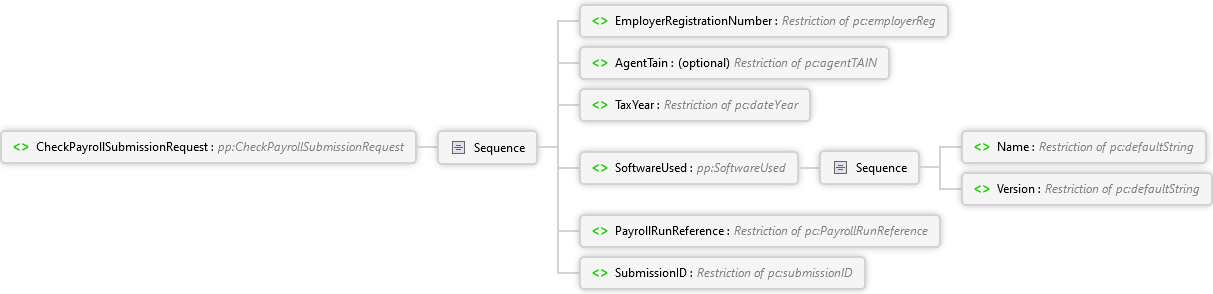

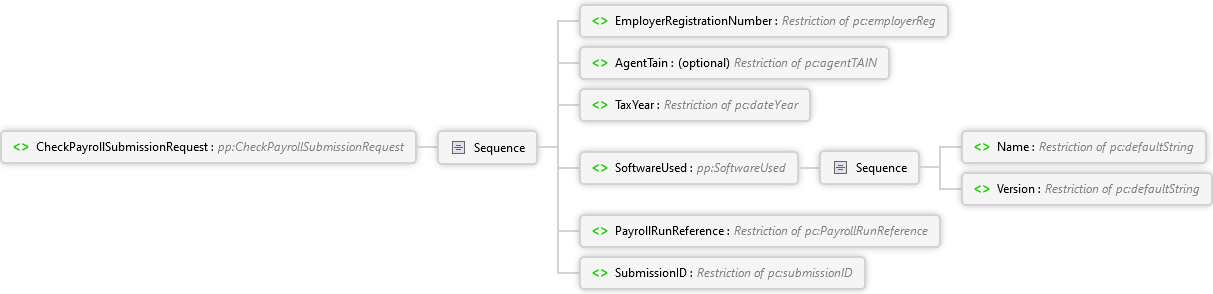

The request body is of type CheckPayrollSubmissionRequest.

Overview

|

CheckPayrollSubmissionRequest

Request to check the current status of an Employer's PAYE Payroll Submission, based on the Submission ID.

|

| Method | CheckPayrollSubmissionOperation |

The request body is of type CheckPayrollSubmissionRequest.

|

CheckPayrollSubmissionRequest

Request to check the current status of an Employer's PAYE Payroll Submission, based on the Submission ID.

|

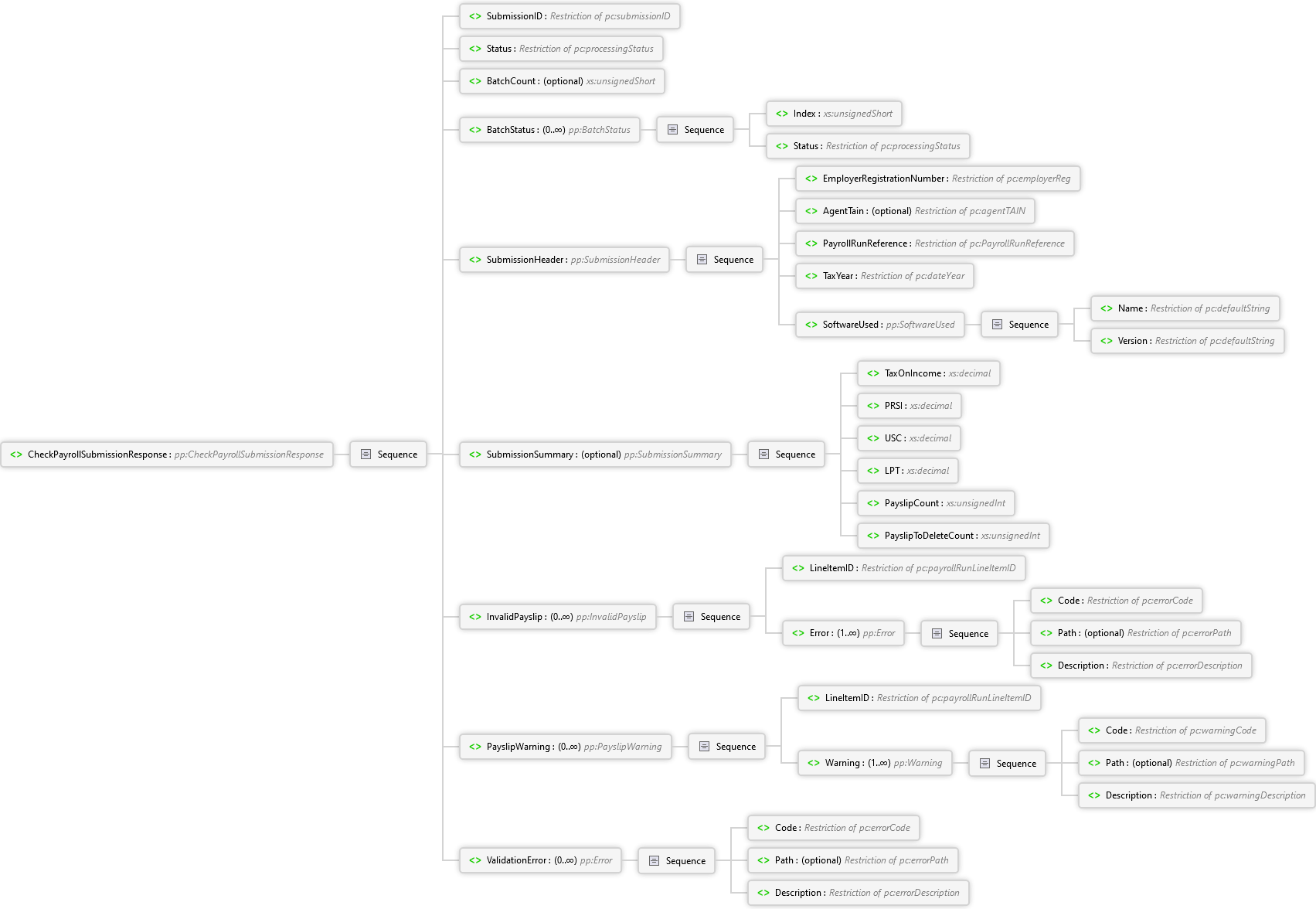

The response body is of type CheckPayrollSubmissionResponse.

|

CheckPayrollSubmissionResponse

Return the current status of an Employer's PAYE Payroll Submission. If processed, includes summary totals of valid payslips and validation errors for invalid payslips.

|

<?xml version="1.0" encoding="UTF-8"?> <!--Document History: ======== Version 0.9 ==================================== i. Document Created 30/06/2017 ======== Version 0.10 ==================================== ii. Document updated on 07/09/2017: The element "TaxYear" was added to the "CheckPayrollSubmissionRequest" The element "RunReference was added to the CheckPayrollSubmissionRequest" ======== Version 1.0 Milestone 1 ==================================== iii. Document updated on 17/11/2017: Renamed the element: "RunReference" to "PayrollRunReference" ======== Version 1.0 Milestone 2 ==================================== iv. Document updated on 09/02/2018: Date re-formatted ======== Version 1.0 Release Candidate 2 =========== v. Document updated on 24/05/2018 Updated ENUM Values to reflect schematic changes --> <pay:CheckPayrollSubmissionRequest xmlns:pay="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ros.ie/schemas/paye-employers/v1/payroll/payroll-schema.xsd"> <pay:EmployerRegistrationNumber>4587256A</pay:EmployerRegistrationNumber> <pay:AgentTain>45879C</pay:AgentTain> <pay:TaxYear>2019</pay:TaxYear> <pay:SoftwareUsed> <pay:Name>The Software</pay:Name> <pay:Version>Version 10.0</pay:Version> </pay:SoftwareUsed> <pay:PayrollRunReference>0000001</pay:PayrollRunReference> <pay:SubmissionID>05</pay:SubmissionID> </pay:CheckPayrollSubmissionRequest>

<?xml version="1.0" encoding="UTF-8"?> <!--Document History: ======== Version 0.9 ==================================== i. Document Created 30/06/2017 ======== Version 1.0 Milestone 1 ==================================== iii. Document updated on 17/11/2017: Renamed the element: "RunReference" to "PayrollRunReference" Removed the element: "SubmissionType" ======== Version 1.0 Release Candidate 2 =========== v. Document updated on 24/05/2018 Updated ENUM Values to reflect schematic changes --> <pay:CheckPayrollSubmissionResponse xmlns:pay="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ros.ie/schemas/paye-employers/v1/payroll/payroll-schema.xsd"> <pay:SubmissionID>05</pay:SubmissionID> <pay:Status>COMPLETED</pay:Status> <pay:BatchCount>6</pay:BatchCount> <pay:BatchStatus> <pay:Index>1</pay:Index> <pay:Status>COMPLETED</pay:Status> </pay:BatchStatus> <pay:SubmissionHeader> <pay:EmployerRegistrationNumber>4587256A</pay:EmployerRegistrationNumber> <pay:PayrollRunReference>0000001</pay:PayrollRunReference> <pay:TaxYear>2019</pay:TaxYear> <pay:SoftwareUsed> <pay:Name>The Software</pay:Name> <pay:Version>Version10.0</pay:Version> </pay:SoftwareUsed> </pay:SubmissionHeader> <pay:SubmissionSummary> <pay:TaxOnIncome>1334.48</pay:TaxOnIncome> <pay:PRSI>1535.55</pay:PRSI> <pay:USC>333.94</pay:USC> <pay:LPT>48.75</pay:LPT> <pay:PayslipCount>6</pay:PayslipCount> <pay:PayslipToDeleteCount>0</pay:PayslipToDeleteCount> </pay:SubmissionSummary> </pay:CheckPayrollSubmissionResponse>