Return the current status of an Employer's PAYE Payroll Submission. If processed, includes summary totals of valid payslips and validation errors for invalid payslips.

Payroll Schema

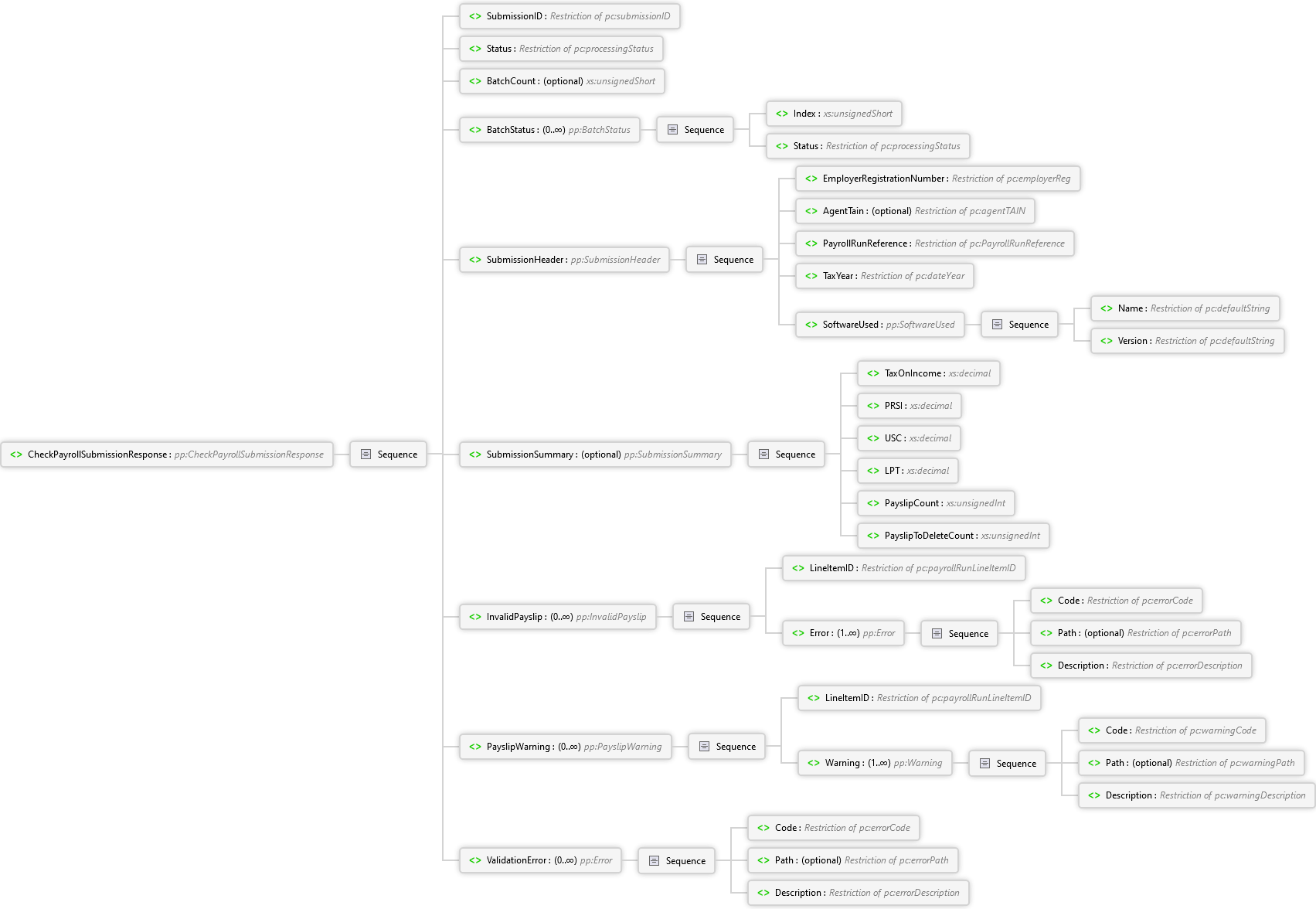

CheckPayrollSubmissionResponse Element

| Namespace | http://www.ros.ie/schemas/paye-employers/v1/payroll/ |

|

CheckPayrollSubmissionResponse CheckPayrollSubmissionResponse Complex Type

Return the current status of an Employer's PAYE Payroll Submission. If processed, includes summary totals of valid payslips and validation errors for invalid payslips.

|

|