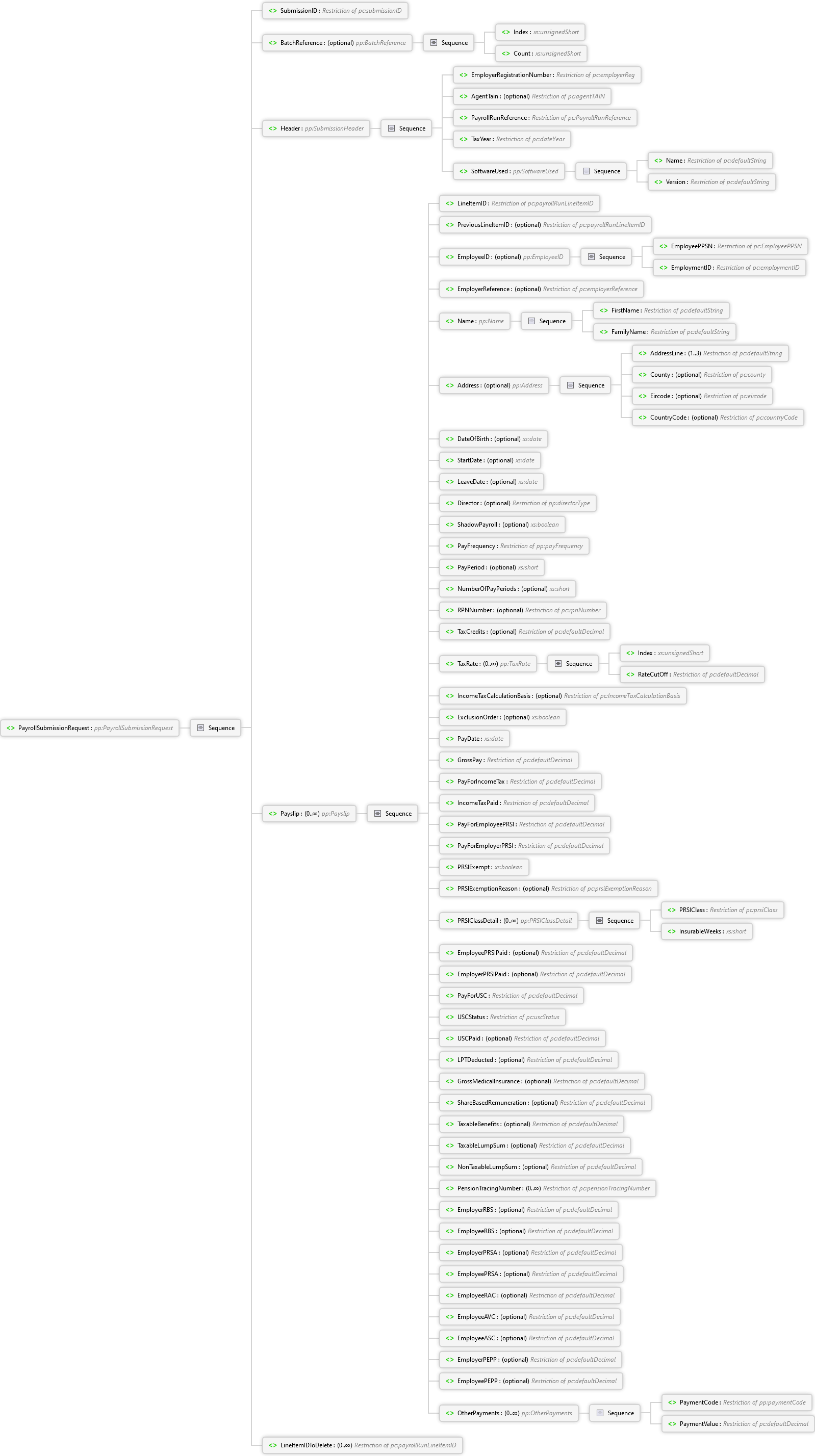

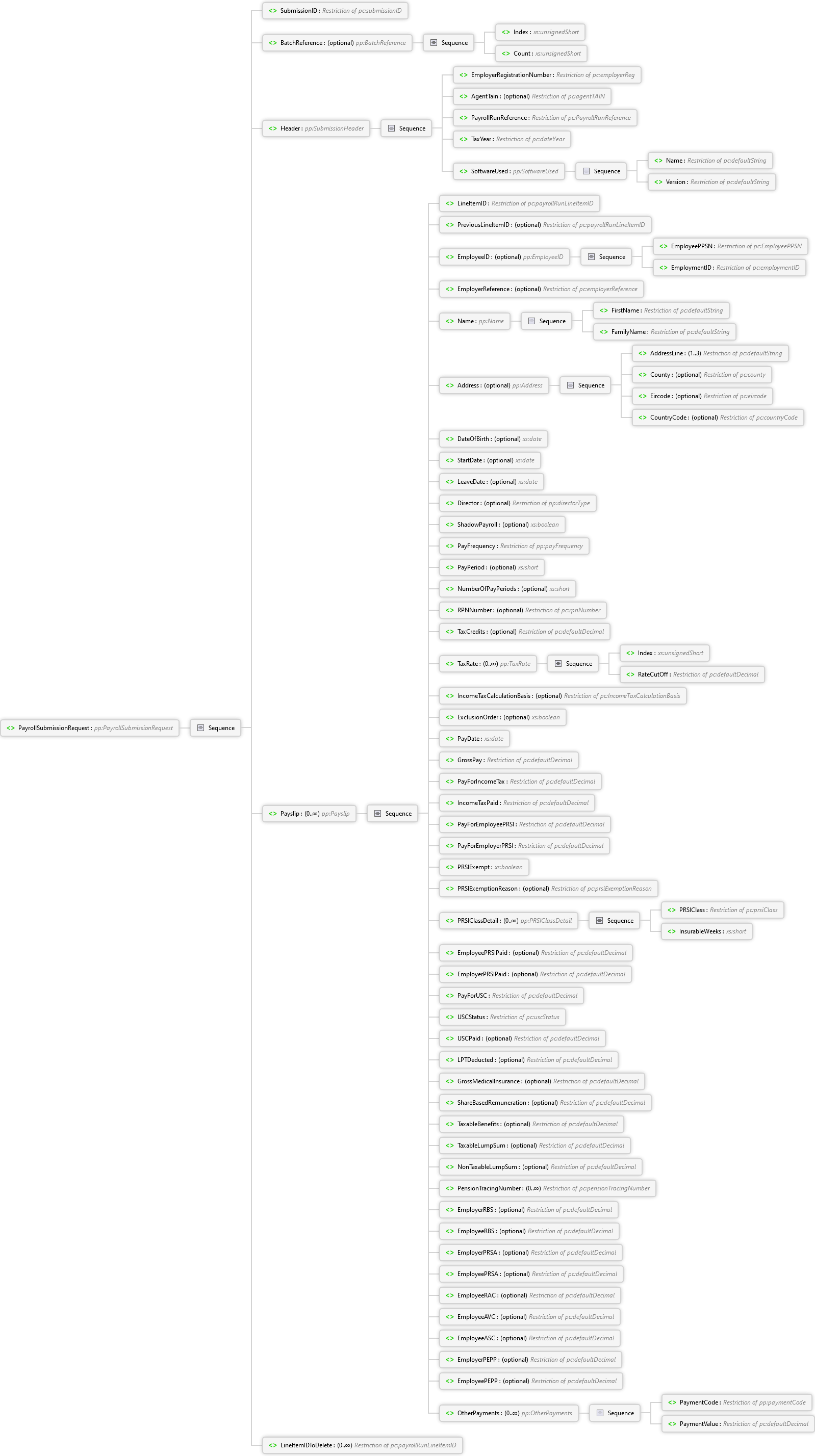

The request body is of type PayrollSubmissionRequest.

Overview

|

PayrollSubmissionRequest

Employer's PAYE Payroll Submission Request.

|

| Method | PayrollSubmissionOperation |

The request body is of type PayrollSubmissionRequest.

|

PayrollSubmissionRequest

Employer's PAYE Payroll Submission Request.

|

The response body is of type PayrollSubmissionResponse.

|

PayrollSubmissionResponse

Acknowledges the receipt of an Employer's PAYE Payroll Submission Request, or Validation Errors if validation failed.

|

<?xml version="1.0" encoding="UTF-8"?> <!--Document History: ======== Version 0.9 ==================================== i. Document Created 30/06/2017 ======== Version 0.10 ==================================== ii. Document updated on 07/09/2017: Renamed the element: “Class" (type="pc:prsiClass") to “PRSIClass” Revenue Payroll Instruction changed to Revenue Payroll Notification and RPI changed to RPN ======== Version 1.0 Milestone 1 ==================================== iii. Document updated on 17/11/2017: Renamed the element: "RunReference" to "PayrollRunReference" Renamed the element: "PPSN" to "EmployeePPSN" Renamed the element: "calculationBasis" to "IncomeTaxCalculationBasis" Removed the element: "SubmissionType" ======== Version 1.0 Milestone 2 ==================================== iv. Document updated on 09/02/2018: Dates re-formatted ======== Version 1.0 Release Candidate 2 =========== v. Document updated on 24/05/2018 Updated ENUM Values to reflect schematic changes --> <pay:PayrollSubmissionRequest xmlns:pay="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ros.ie/schemas/paye-employers/v1/payroll/payroll-schema.xsd"> <pay:SubmissionID>01</pay:SubmissionID> <pay:Header> <pay:EmployerRegistrationNumber>3980609P</pay:EmployerRegistrationNumber> <pay:PayrollRunReference>00001</pay:PayrollRunReference> <pay:TaxYear>2019</pay:TaxYear> <pay:SoftwareUsed> <pay:Name>The Software</pay:Name> <pay:Version>Version 10.0</pay:Version> </pay:SoftwareUsed> </pay:Header> <pay:Payslip> <pay:LineItemID>E1-v1</pay:LineItemID> <pay:EmployeeID> <pay:EmployeePPSN>00000008P</pay:EmployeePPSN> <pay:EmploymentID>1</pay:EmploymentID> </pay:EmployeeID> <pay:Name> <pay:FirstName>Ann</pay:FirstName> <pay:FamilyName>Doe</pay:FamilyName> </pay:Name> <pay:PayFrequency>WEEKLY</pay:PayFrequency> <pay:PayPeriod>5</pay:PayPeriod> <pay:RPNNumber>5</pay:RPNNumber> <pay:TaxCredits>63.46</pay:TaxCredits> <pay:TaxRate> <pay:Index>1</pay:Index> <pay:RateCutOff>650</pay:RateCutOff> </pay:TaxRate> <pay:IncomeTaxCalculationBasis>CUMULATIVE</pay:IncomeTaxCalculationBasis> <pay:PayDate>2019-02-01</pay:PayDate> <pay:GrossPay>307.50</pay:GrossPay> <pay:PayForIncomeTax>307.50</pay:PayForIncomeTax> <pay:IncomeTaxPaid>0.00</pay:IncomeTaxPaid> <pay:PayForEmployeePRSI>307.50</pay:PayForEmployeePRSI> <pay:PayForEmployerPRSI>307.50</pay:PayForEmployerPRSI> <pay:PRSIExempt>false</pay:PRSIExempt> <pay:PRSIClassDetail> <pay:PRSIClass>A0</pay:PRSIClass> <pay:InsurableWeeks>5</pay:InsurableWeeks> </pay:PRSIClassDetail> <pay:EmployeePRSIPaid>0.00</pay:EmployeePRSIPaid> <pay:EmployerPRSIPaid>33.06</pay:EmployerPRSIPaid> <pay:PayForUSC>307.50</pay:PayForUSC> <pay:USCStatus>ORDINARY</pay:USCStatus> <pay:USCPaid>3.07</pay:USCPaid> <pay:LPTDeducted>3.67</pay:LPTDeducted> </pay:Payslip> </pay:PayrollSubmissionRequest>

<?xml version="1.0" encoding="UTF-8"?> <!--Document History: ======== Version 0.9 ==================================== i. Document Created 30/06/2017 ======== Version 1.0 Milestone 1 ==================================== iii. Document updated on 17/11/2017: Renamed the element: "RunReference" to "PayrollRunReference" Removed the element: "SubmissionType" ======== Version 1.0 Release Candidate 2 =========== v. Document updated on 24/05/2018 Updated ENUM Values to reflect schematic changes --> <pay:CheckPayrollSubmissionResponse xmlns:pay="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns="http://www.ros.ie/schemas/paye-employers/v1/payroll/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ros.ie/schemas/paye-employers/v1/payroll/payroll-schema.xsd"> <pay:SubmissionID>05</pay:SubmissionID> <pay:Status>COMPLETED</pay:Status> <pay:BatchCount>6</pay:BatchCount> <pay:BatchStatus> <pay:Index>1</pay:Index> <pay:Status>COMPLETED</pay:Status> </pay:BatchStatus> <pay:SubmissionHeader> <pay:EmployerRegistrationNumber>4587256A</pay:EmployerRegistrationNumber> <pay:PayrollRunReference>0000001</pay:PayrollRunReference> <pay:TaxYear>2019</pay:TaxYear> <pay:SoftwareUsed> <pay:Name>The Software</pay:Name> <pay:Version>Version10.0</pay:Version> </pay:SoftwareUsed> </pay:SubmissionHeader> <pay:SubmissionSummary> <pay:TaxOnIncome>1334.48</pay:TaxOnIncome> <pay:PRSI>1535.55</pay:PRSI> <pay:USC>333.94</pay:USC> <pay:LPT>48.75</pay:LPT> <pay:PayslipCount>6</pay:PayslipCount> <pay:PayslipToDeleteCount>0</pay:PayslipToDeleteCount> </pay:SubmissionSummary> </pay:CheckPayrollSubmissionResponse>